Dairyu online store drives sales 12.4% up

Dairyu online store drives sales 12.4% up for the tagged product listings compared to the non tagged product listings in the same period of time. Page visits are 14.6% up and conversion to sale more than doubles.

COMPANY OVERVIEW

Dairyu is a Japanese online store that sells clothing, shoes and accessories, as well as designated professional outfits such as nurse uniforms, and constructs clothes and protection. Dairyu operates a Rakuten marketplace store, where it sells approximately 8 thousands of products as well as a destination site under its own domain.

THE PROBLEM

After a period of time operating in the Rakuten marketplace, Dairyu noticed a considerable gap between the existing volume of tagging meta data and the potential that can be obtained. Knowing the gap, Dairyu searched for a solution that will automate the tagging process and improve products’ performance on the Rakuten marketplace.

THE SOLUTION

The company assumption was that increase in findability will boost performance. This increase in findability would be achieved through improvement of data tags on the marketplace ensuring higher appearance in the aspect search results.

METHODOLOGY

To validate the company assumption, Lisuto conducted a case study in which the company collected the performance measurements across four KPI’s: sales, page views, unique user visits and conversion rate.

The case study took place over a period of three months, starting August 2021, before any tags generated by the Xtag system were applied, serving as a benchmark. The tagging was applied to a selected group of products and the results of the following months - September and October 2021 - were then compared to August’s results between the two groups - the group where the tags were applied and the group that remained in the previous tagging state as in the benchmark month.

The data collected during the test period includes only that regarding the top 1,000 most viewed tagged products and the top 1,000 most viewed untagged products during the test period, to serve as a control group.

THE RESULTS

The case study’s results show that tagged products did significantly better than untagged products throughout the test period, and across all KPI’s examined.

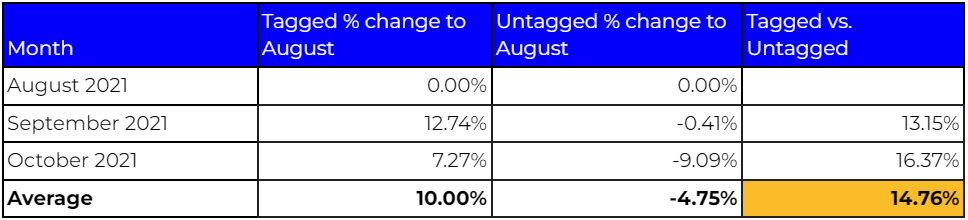

Page views

Examining the page views indicator results, we get a similar picture - tagged products significantly outperforms untagged products.

In September, untagged products suffered a slight drop in page views compared to August. This is sharply contrasted with an almost 13% boost in page views enjoyed by tagged products.

In October it appeared site traffic waned a bit, but still, while tagged products registered an increase compared to August, untagged products dropped by nearly 10%.

On average, tagged products outperformed untagged products by 14.76% throughout the test period.

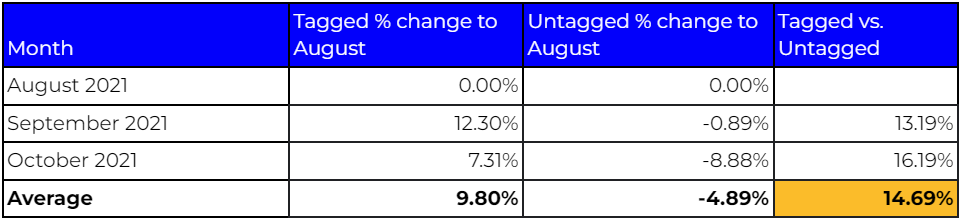

Unique Users

The unique user visits indicator results keep up with the trend. In September, untagged products experienced a slight drop in unique user visits, compared to the previous month. However, during the same month, tagged products enjoyed an increase of more than 12% in unique user visits compared to August.

As in page views, tagged products still maintain a 7.3% increase during the month of October, contrasted with an almost 9% drop for untagged products.

Very similarly to page views, tagged products did better than untagged products by an average of almost 15%.

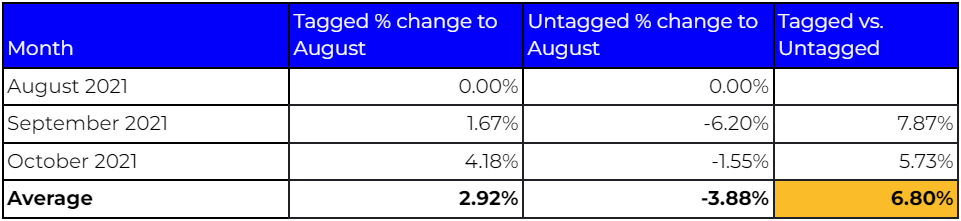

Conversion to sale

Not surprisingly, the conversion rate results again show the superiority of tagged products over untagged products. In September, while untagged products’ conversion rates decreased by 6.2% compared to August, tagged products were able to still maintain a slight increase.

October was a little better for both types of products. The drop in untagged products’ conversion rate was curtailed, but were still lower than in September. At the same time, untagged products saw an increase in conversion rates, both compared to August and September.

During the test period, tagged products outperformed untagged products by an average of almost 7% in terms of conversion rate.

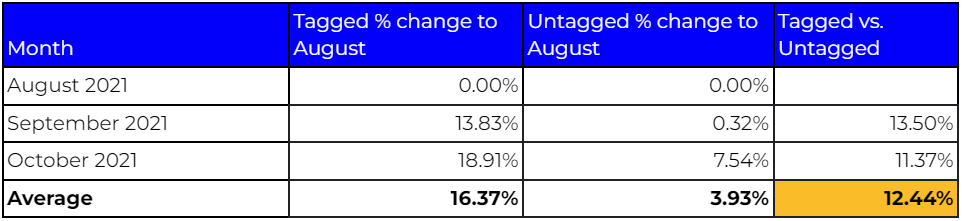

Sales

The results of the sales indicator show the superiority of tagged products over untagged products. In September, the first month of tagging, tagged products improved by almost 14% from the previous month of August, while untagged products barely moved.

In October, untagged products recovered, improving by 7.5% compared to August, but this increase was overshadowed by the almost 20% increase in sales by tagged products.

Overall, throughout the test period, tagged products did better than untagged products in terms of sales by an average of 12.44%.

CONCLUSION

The results of this case study and the fact that Dairyu online store drives sales 12.4% up for the tagged product listings join a line of other case studies conducted by Lisuto to measure the impact of tagging on performances, such as Cox, Hikari, Mizuno, Naturum, and more. All strongly confirm the assumption that product tagging significantly improves product findability in the marketplaces and subsequently improves all performance parameters including page views, number of unique viewers, conversion rate and ultimately the sales.