Himeji city online store – sales up 25% case study

The impact of data tagging on sales for Himeji city online store was over 25% more sales for tagged items compared to the non tagged items at the same period of time. Similar positive gap observed in page views, unique users and conversion KPIs.

COMPANY OVERVIEW

Himeji City Prefectural Shop is headquartered in Himeji, Hyogo Prefecture, Japan. With a population of over half a million people, the city and its surrounding attract millions of tourists every year, offering such sights as the Himeji Castle, a UNESCO world heritage site. The Himeji City Prefectural Shop sells branded souvenirs and locally made goods, and has opened a store on Rakuten.

THE PROBLEM

The Himeji City Prefectural Shop was not satisfied with its sales on Rakuten, so it turned to Lisuto to text tagging its products, seeking to improve its exposure on the marketplace.

THE SOLUTION

In order to measure the impact of tagging, Lisuto and the city of Himeji conducted a case study. The goal of the case study has been to examine how tagging affected four main KPI’s - sales, page access, unique user visits and conversion rate. The study took place over three months, beginning in November 2021, and ending in January 2022.

METHODOLOGY

November 2021 - served as a benchmark for later months as no products have been tagged at that time. The case study reviewed only the top 1,000 most viewed tagged products during the test period, and used the top 1,000 most viewed untagged products as a control group.

THE RESULTS

The results of the case study bring further evidence of the positive impact of properly tagged products. Tagged products consistently did better than untagged products throughout the test period, in all the KPI’s we examined.

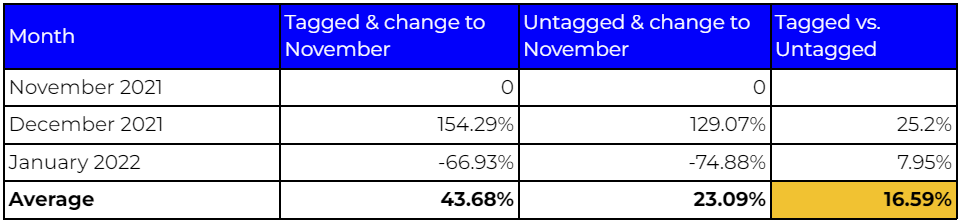

Sales

The sales results indicate that tagging improves product performance in terms of sales. In December, both tagged and untagged products enjoyed a significant boost in sales (naturally, due to the holiday season). Despite both having a successful month, tagged products still managed to outperform untagged products, improving their sales for November by more than 156%, which were 25% better than untagged products.

After the rise in December, came the seasonal decline in January. Tagged products and untagged products both declined in sales during this month, but tagged products were more resilient to the downturn, and managed to stop after a 66% drop. Untagged products, by comparison, kept falling all the way to -75% during the same month.

Overall, during the test period, tagged products performed better in terms of sales than untagged products by 16.6% on average.

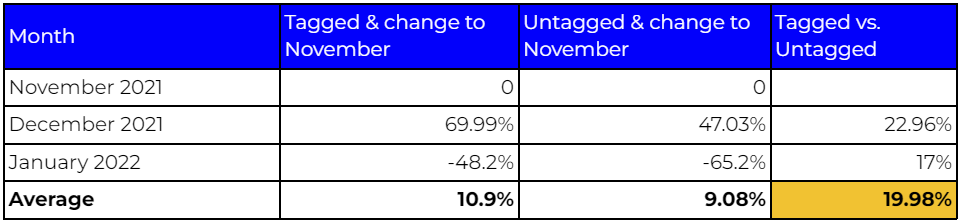

Page Access

The results for the page access metric are also clearly in favor of tagged products. While both types of products again experienced a surge in page access during December, tagged products enjoyed over 23% more visits than untagged products.

In January, both tagged and untagged products saw a downturn in page access. However, the results show the tagged products have been much more resilient, limitinging their decline to less than 50%, compared to over 65% for untagged products.

Throughout the test period, tagged products performed on average almost 20% better than untagged products, in terms of page access.

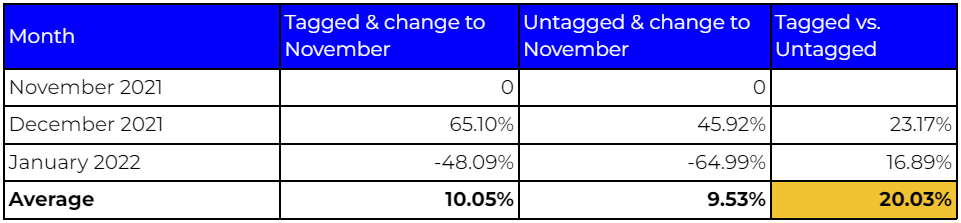

Unique Users

The same trend continues in the results for the unique users metric. December brought a sharp increase in unique user visits for both types of products, but tagged products did significantly better, outperforming untagged products by over 23%.

Once again, January brought a downturn in unique user visits across the board, but again, tagged products were able to sustain the drop below 50% while untagged products declined to 65%.

Tagged products have once more proved their advantage in months of heavy traffic, as well as their resilience in times of declining number of unique user visits.

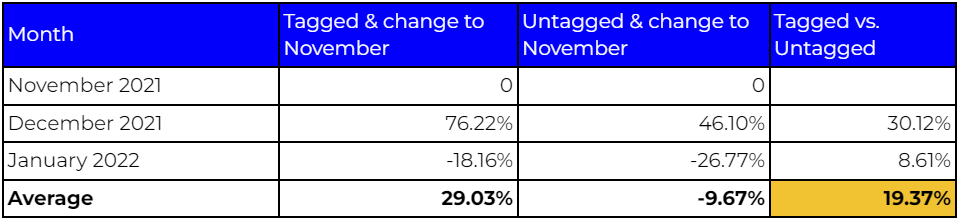

Conversion Rates

Finally, the results for the conversion rates clearly emphasize the significant advantage tagged products have over untagged products. December has been great for tagged products, reaching an almost 77% increase in conversion rates compared to November. During the same period, untagged products improved by 46%, trailing after tagged products by a 30%.

As expected, there was a decline in conversion rates in January, as traffic overall came down. While both types of products saw a decrease in conversion rates, tagged products’ decline has been 8.6% lower than that of untagged products, compared to November.

Consistent with the results for the other metrics we examined, tagged products proved they perform much better overall than untagged products.

CONCLUSION

The results of the case study corroborate the assumption that tagging has a positive impact on products’ performances. Throughout the test period, and across all KPI’s examined, tagged products showed better resolves, whether it is enjoying higher increase, or sustaining relatively minor losses compared to untagged products.

The results of the case study also fall within the trend appearing in other case studies conducted by Lisuto, such as Mizuno, Naturum, and more.

With such a significant impact on KPI within three months, investment of resources and effort into the product tagging is a wise decision that is bound to produce significant returns.